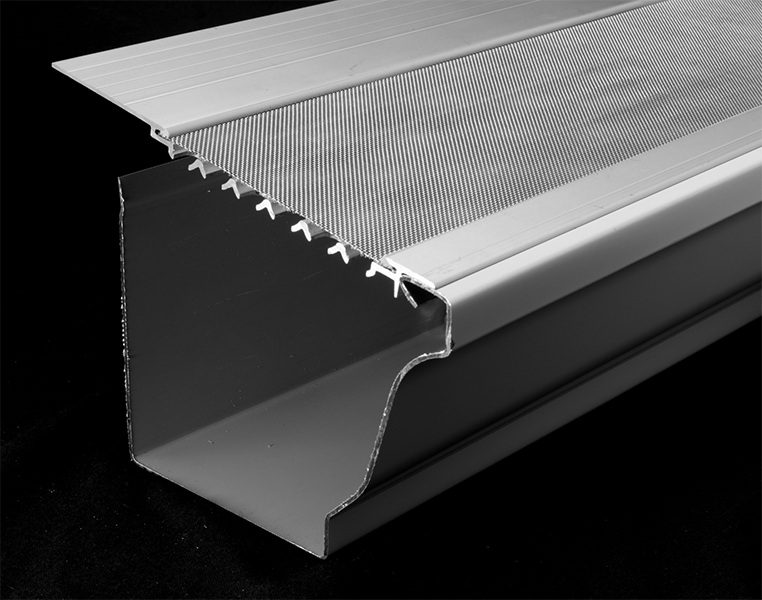

If you are conscious about the appearance of your gutter system but you still want gutter guards installed, there is a solution for this. You do not have to install visible gutter covers. The louvered gutter guards otherwise known as non-gutter covers are a great option that are functional. How is it that they are not visible but they still serve the purpose? They are made from a thin aluminum material that allows water to run and debris slides over.

What Are the Advantages of Louvered Gutter Guards?

There are several advantages that come with these kinds of gutter guards besides making it possible for water to flow freely.

· It is easy to install. Unlike some other gutter covers that are time consuming, installing this particular type is relatively easy.

· The gutter guards are durable. Every homeowner wants to install a system that is durable. Made of perforated aluminum metal, these guards are heavy duty and durable for your home.

· Requires low maintenance. Some gutter guards will require regular maintenance and this becomes a lot of work. With non-gutter covers, they are easy to maintain and convenient when it comes to removal and installation.

· Fits all kinds of gutters. you could be wondering whether it will fit your gutters. the beauty about these covers is that they are suitable for all kinds of gutters.

· They prevent clogging. Since they are designed with special holes, they keep debris out and allow wait to flow freely which prevents clogging.

· They can be customized. If you are not comfortable with what is available, you can easily get your own designed.

Does its Installation Affect the Roof?

The answer is no and the advantage is that it is easy to install. What makes it easy to install is that you will only need to position it under the shingles on the first row of your roof. You can opt to have it fastened with screws or snap it into the gutter. It’s advisable that screws are used to ensure a firm installation without disturbing the shingles. This will prevent any voidance of warranty or damages.

The Durability of Louvered Gutter Guards

It’s easy to get cheap gutter guards out there that you will feel like they offer the best protection. The problem comes where there is heavy rainfall and they start sagging. They start to give in to the pressure and they must be replaced. You need durable gutter guards that will serve you for a longtime to come. Louvered gutter guards serve the purpose well and are durable.

The most important function of gutter guards is to divert rain water from the roof. However, some will be more suitable for some homes than for others. If you want your gutters to be replaced, the louvered gutter guards become the best option as they have thin louvers for the purpose. It also easily fits your pitch as it is easily bendable. If you like cleaning your own gutter, this will be easy to clean.